Would-be homebuyers aren’t sitting on the sidelines because they don’t want to buy. They’re waiting because they think they can’t. And for many renters here in Lake County, Illinois, it’s their credit score that’s holding them back.

According to a Bankrate survey, 2 out of every 5 Americans (42%) believe you need excellent credit to qualify for a mortgage. That belief comes up often when renters in places like Libertyville, Grayslake, Mundelein, and Gurnee are asked why they don’t own yet — “my credit isn’t good enough” is one of the most common answers.

Maybe you’re in that same boat. You’ve checked your score, compared it to what you think lenders require, and assumed buying your first home in Lake County just isn’t realistic right now.

But here’s what you need to know.

You Don’t Need Perfect Credit to Buy a Home

Even though many people assume you need flawless credit to buy a house, that’s not necessarily the case — especially for first-time buyers in Northern Illinois.

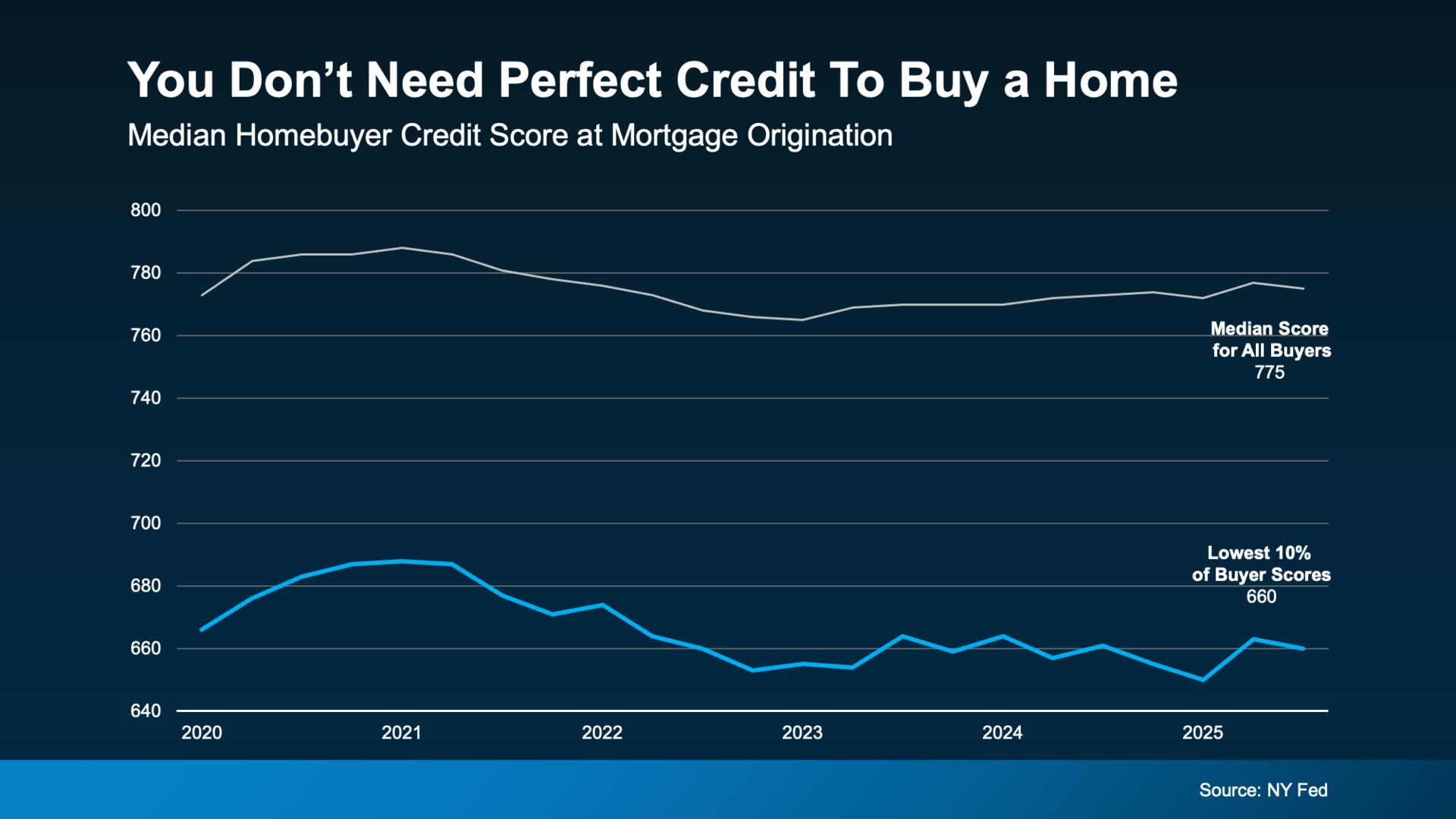

Part of the confusion comes from the fact that today’s typical buyer does have strong credit. According to data from the New York Fed, the median credit score for all buyers is 775.

But that doesn’t mean you need a score that high to qualify.

When you look at recent homebuyers, many successfully purchased homes with scores well below that level. Data shows that 10% of buyers had scores around 660. Some were higher, some were lower — but that range still resulted in approved mortgages and closed homes.

In other words, a less-than-perfect credit score doesn’t automatically disqualify you from buying a home in Libertyville or the surrounding Lake County suburbs.

FICO itself explains it clearly:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

That’s why the smartest next step isn’t guessing — it’s having a real conversation with a local mortgage lender who understands the Lake County market. Many buyers are purchasing homes with credit scores in the 600s, and depending on your situation, that could include you too.

Bottom Line

Your credit score matters — but it doesn’t have to be perfect.

If credit concerns have been the reason you’ve been waiting to buy a home in Lake County, IL, it may be time to take another look at your options. Programs, lending guidelines, and local price points all play a role, and they’re constantly changing.

If you want help understanding where you stand — or you’d like an introduction to a trusted local lender who works with first-time buyers and move-up buyers in Libertyville and surrounding communities — start the conversation.

You don’t need to have everything figured out to take the first step.

Let’s Connect

Text “HOME” to (224) 544-9080 — no pressure. Clear guidance, honest advice.